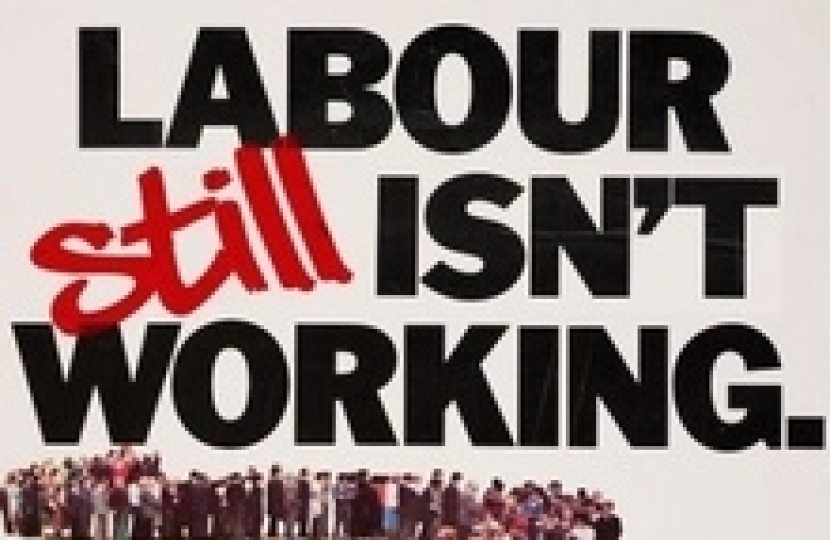

Unfortunately it seems the Labour Party, having bankrupted the nation’s finances and currently seeing their economic argument lie in tatters, have now shamelessly shifted their PR spin and focus to living standards in recent weeks.

In the past we have seen Ed Balls criticise the Chancellor for attempting to get a grip on our country’s budget deficit and then Balls has used the phantom double-dip recession as ‘proof’ of his tax and spend alternative. However this summer the Labour Party has decided to take a break from attacking Ed Miliband’s leadership to try and weave together a different narrative for attacking the Government in view of the fact that our economy has now turned a positive corner. On a local level here in Lincoln and surrounding areas, this has taken the form of Labour representatives shamelessly, and perhaps pretty ineffectually attacking the Government on living standards, despite some of them having enjoyed very privileged backgrounds and highly paid jobs in the UK.

Perhaps higher rate earners saw their wages keep up with inflation during Labour’s time in office before the recession, but this effect wasn’t felt for most people. Indeed, between 2003 and 2008 median hourly pay grew by 0.3% a year at a time when the economy grew by 1.4%. At the same time, median pay growth never outpaced inflation and gross disposable income fell by 1.1%. Many people might not have felt these effects as Labour’s high public spending sought to subsidise this weak wage growth and the truth is we are still paying for that reckless spending now.

It’s all very good to complain about inflation levels post 2010, but you need to take into account other things such as employment and economic growth when looking at our current economic position. If Labour’s discredited economic view was to be believed, by their measure of success we should be asking Greece for economic guidance, although in reality that is probably the last thing we would want to do.

Leaving that aside, I think it is important to take a look at Labour’s policies (or rather the handful of ideas which have been recycled over the last few years with little substance to explain how to pay for ever increasing spending commitments) and ask whether they seek to provide economic growth.

First of all we have the idea of reintroducing the 10% tax rate, which was abolished back in 2008 under Gordon Brown and saw families up and down the country pay 20% income tax on earnings just over £5,000. Whilst I think we all want to see people keep more of their hard earned money, this announcement is just too little too late, as by April 2014 the Conservative-led Government will have increased personal allowances up to £10,000, and over two million people will no longer be paying tax in their earnings at all.

Secondly we have the idea of greater state intervention in the railway industry. Whilst there are undoubtedly some outliers as in any market, the Government is capping the average regulated fare increases at one per cent in real terms. Of course any increase above inflation in unpalatable but it is important to remember the type of rail industry inherited back in May 2010. The McNulty report found that UK railways were 20% more expensive than their European counterparts and that this inefficiency was backed up by significantly higher state funding. All in all, McNulty found that there was a 40% efficiency gap which is currently being paid for by passengers and taxpayers and this cannot be fixed overnight.

Next we have the local Labour Party advocating a return to the bloated tax credits system, which between 2003 and 2010 was costing us all an eye watering £171 billion and which by 2010 was costing every household in Britain an extra £3,000 a year. These increases were used in part to fund a 58% increase ahead of the 2005 General Election to curry electoral favour and we saw the same trick applied in 2010 with the 50% tax rate. Taxpayers want and now have transparency and can see the tax credits system was completely discredited, Labour want to take us back to the dark ages.

It may surprise many of you to know that the 50% tax rate was only introduced in April 2010, less than 30 days before the 2010 General Election after 13 years of Labour being in Government without making this change. Such a delay can only be explained by the fact that this higher tax rate would not have brought the vast sums of revenue which Labour, now in opposition, claim it would and that the sole purpose of this measure, like the ill fated cider tax, was to provide a Labour attack line against the new Government.

It is also surprising to see the Labour Party locally talk about energy bills and abolishing Ofgem given that their Leader Ed Miliband spent two years overseeing that organisation at the Department for Energy & Climate Change and didn’t think to make this decision during that time. That is because abolishing an energy regulator and replacing it with another type of regulator is nonsensical, especially in light of the fact that Ofgem is currently taking forward a package of measures to help reduce energy bills and make the energy market fairer. This comes at the same time as the Government’s plans within the Energy Bill to make sure suppliers put consumers on the lowest tariffs unless they choose otherwise.

Labour’s so-called cure for living standards is to take advantage of the proverbial six month’s interest free credit and max out the nation’s credit card all over again. I for one don’t want to pick up that tab again and I suspect many of my constituents feel the same way. As has been said before, voting Labour will be the equivalent of giving the car keys back to the drunk who crashed the car in the first place. Locally in Lincoln Labour have proved they still have a fuzzy head and a raging hangover.